The Staples Industry is known for its durability in various economic climates. Consequently, the RSPD ETF has achieved considerable investor focus as a method to participate this sector's potential. This article delves into the performance of the RSPD ETF, analyzing its holdings and core drivers to provide insights into its suitability for investors seeking exposure to essential products.

- Essentially, the RSPD ETF aims to mirror the performance of a broad index of companies operating in the consumer staples industry.

- Additionally, the ETF's assets are predominantly composed of leading companies that produce everyday items.

- Nevertheless, it is crucial to consider the ETF's volatility profile, as even within resilient sectors, industry dynamics can impact performance.

Consequently, a thorough analysis of more info the RSPD ETF's structure, its correlation to its benchmark, and the broader market landscape is crucial for investors seeking to gauge its suitability within their investment allocations.

Analyzing the Returns of the Equal Weight Consumer Staples ETF (RSPD)

The Comparable Weight Consumer Staples ETF (RSPD) has gained considerable momentum among investors seeking exposure to the consistent consumer staples sector. Reviewing RSPD's recent returns uncovers a pattern of robust outcomes. This can be linked to several influences, such as the industry's intrinsic durability.

- Additionally, RSPD's equal-weighting methodology can contribute its success by reducing the impact of any single holding.

- Nevertheless, it's crucial to perform a in-depth analysis of RSPD's holdings and volatility profile before making any investment strategies.

Ultimately, understanding RSPD's underlying influences can assist investors formulate more informed decisions about its suitability for their portfolios.

Could RSPD be the Right Choice for Your Consumer Staples Exposure?

When navigating your ever-changing consumer staples market, investors frequently searching for diversified and stable exposures. An emerging option that has been gaining momentum is the consumer staples-focused exchange-traded fund (ETF), RSPD. But should investors consider RSPD truly represent right choice for your portfolio?

- Consider dive into some key factors to assist you toward an informed decision.

Navigating Market Volatility with the RSPD ETF

The marketplace landscape can be a turbulent one, often leaving investors feeling anxious. During periods of uncertainty, it's essential to have a diversified portfolio that can weather the ups and downs. The RSPD ETF, a innovative investment vehicle, offers a potential solution for investors seeking to mitigate their risk to market volatility.

- Selectively constructed to track the growth of a basket of stocks, the RSPD ETF aims to provide investors with consistent returns even in volatile market conditions.

- Employing a comprehensive investment strategy, the ETF seeks to optimize risk-adjusted returns, offering investors a viable avenue for long-term accumulation.

- Furthermore, the RSPD ETF's transparent structure allows investors to easily understand its components, fostering a feeling of participation over their investments.

Engaging in the financial markets can be a rewarding endeavor, but it's essential to navigate it with wisdom. The RSPD ETF presents a promising opportunity for investors seeking to enhance their portfolios and possibly reduce the impact of market volatility.

Delving into the RSPD ETF: Potential in a Shifting Landscape

The investment landscape is in constant flux, presenting both challenges and chances for savvy investors. Amidst this dynamic environment, Exchange Traded Funds (ETFs) have emerged as a favored choice, offering diversified exposure to various asset classes. One such ETF garnering attention is the RSPD ETF, which concentrates on a unique segment of the market. This article will examine the potential of the RSPD ETF in a shifting landscape, analyzing its strengths and challenges.

- With its specialized portfolio, the RSPD ETF aims to capitalize on the development of a specific industry.

- Understanding the underlying assets of the RSPD ETF is crucial for investors to evaluate its risk-return characteristics.

- Additionally, it's essential to evaluate the results of the RSPD ETF over different market situations.

As investors navigate this evolving landscape, staying aware about the latest trends and changes in the financial system is paramount. The RSPD ETF presents a intriguing case study for those seeking to allocate their portfolios strategically.

Analyzing RSPD ETF Performance: Strategies and Perspectives

Navigating the world of ETFs can be complex, particularly when examining a sector like Land, as seen in the RSPD ETF. Unlocking its performance requires a multi-faceted approach, concentrating on both statistical trends and tactical moves. Investors seeking to benefit on RSPD's potential should carefully analyze its assets composition, pinpointing opportunities within the property market. Furthermore, tracking key indicators, such as interest rates and economic growth, is crucial for making informed investment decisions.

- Assess the RSPD ETF's track record to gauge its potential over intervals

- Compare the RSPD ETF's costs with benchmarks

- Stay informed on industry news that could impact the real estate sector

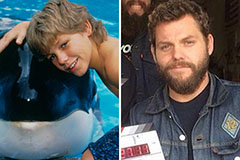

Jason J. Richter Then & Now!

Jason J. Richter Then & Now! Yasmine Bleeth Then & Now!

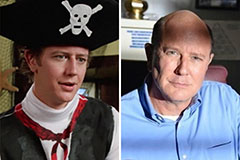

Yasmine Bleeth Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Danielle Fishel Then & Now!

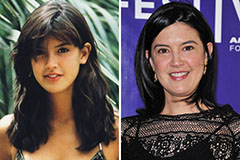

Danielle Fishel Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now!